Ethereum and Bitcoin wallets hit all-time ownership highs

With the sentiment towards cryptocurrencies turning increasingly positive, and the price of most major cryptos seeing a slight uptick after a volatile couple of months, it’s been revealed that the number of people holding Bitcoin and Ethereum has reached a new all-time high.

Blockchain analysis firm, Glassnode, reported that the number of addresses holding over 0.1 ETH (USD$270) has reached an all-time high of 6.8 million.

In a further update posted today, Glassnode noted that addresses holding 0.01 ETH, or about US$26, reached a high of 21.4 million, and that ETH addresses with a non-zero sum also hit an all-time high of 74.2 million.

Growing adoption of cryptocurrencies by retail investors due to the increased ease of purchase could be a factor in this figure, though some point out that this could also be users of the network keeping ETH in reserve for gas fees. Ethereum gas fees have been known to cost nearly US$100 on days when there is heavy network congestion, but typically fluctuate around US$40 to US$80.

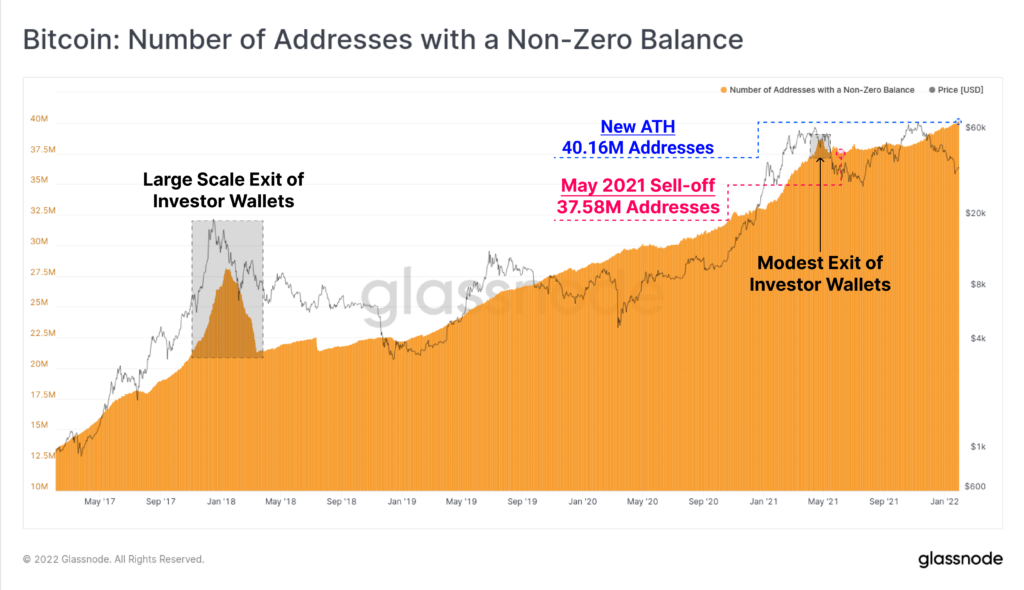

Amount of Bitcoin wallets with non-zero balance hits all-time high

Glassnodes latest weekly report also revealed that the number of Bitcoin wallets with a non-zero balance has also hit new highs, with 40.1 million addresses.

Glassnode noted that this is due to retail investors, those who hold less than 1 BTC, saying that the metric “speaks to a growing class of ‘sat stackers’ and HODLers who remain throughout all market conditions.”

Related: El Salvador rejects IMF’s warning on dangers of Bitcoin

As shown in orange, the uptake in wallets and subsequent purchases of small amounts of Bitcoin has continued despite the price crash, shown along the black line. This closely mirrors the 2019-2020 bear market, where despite no price increases over that time, the number of wallets with at least some Bitcoin continued to grow.

The current trend is different from the other price crashes noted in the picture, the 2017-2018 crash, along with the smaller mid-2021 crash also saw related Bitcoin wallets closing, whereas this crash has seen the opposite.

This could be a sign that bullish conditions will return as more people are entering the Bitcoin market despite the price being on a multi-month downtrend. It also suggests that there are likely people entering now who are long-term investors, and see the lower prices as a sign to establish a position on crypto.

Disclosure: at the time of writing, the author of this feature owned Bitcoin, Ethereum, and other cryptocurrencies.