HSBC buys into the metaverse

British multinational banking giant, HSBC, has dived into the virtual world after purchasing a plot in the decentralised Sandbox metaverse.

Announced via a blog post and on Twitter, HSBC has partnered with The Sandbox, acquiring virtual real estate in its metaverse, which will be developed to engage and connect with sports, esports and gaming enthusiasts.

HSBC is one of the largest banking and financial institutions in the world, its entry into the metaverse follows JP Morgan Chase, which purchased a plot of land in the Decentraland metaverse to create a virtual lounge for its customers in February.

In a statement, Suresh Balaji, Chief Marketing Officer for Asia-Pacific at HSBC, said “the metaverse is how people will experience Web3,” and that the bank sees “great potential to create new experiences through emerging platforms.”

“We’re pleased to see large, trusted institutions such as HSBC join The Sandbox open metaverse and embrace the culture of Web3,” said Sebastien Borget, COO and Co-founder of The Sandbox. “We believe this is the beginning of a broader adoption of Web3 and the metaverse by institutions, driving brand experiences and engagement within this new ecosystem.”

HSBC joins hundreds of business which have partnered with the Sandbox, including Gucci, Warner Music Group, Ubisoft, Snoop Dogg, and Adidas.

SAND token rises with partnership news

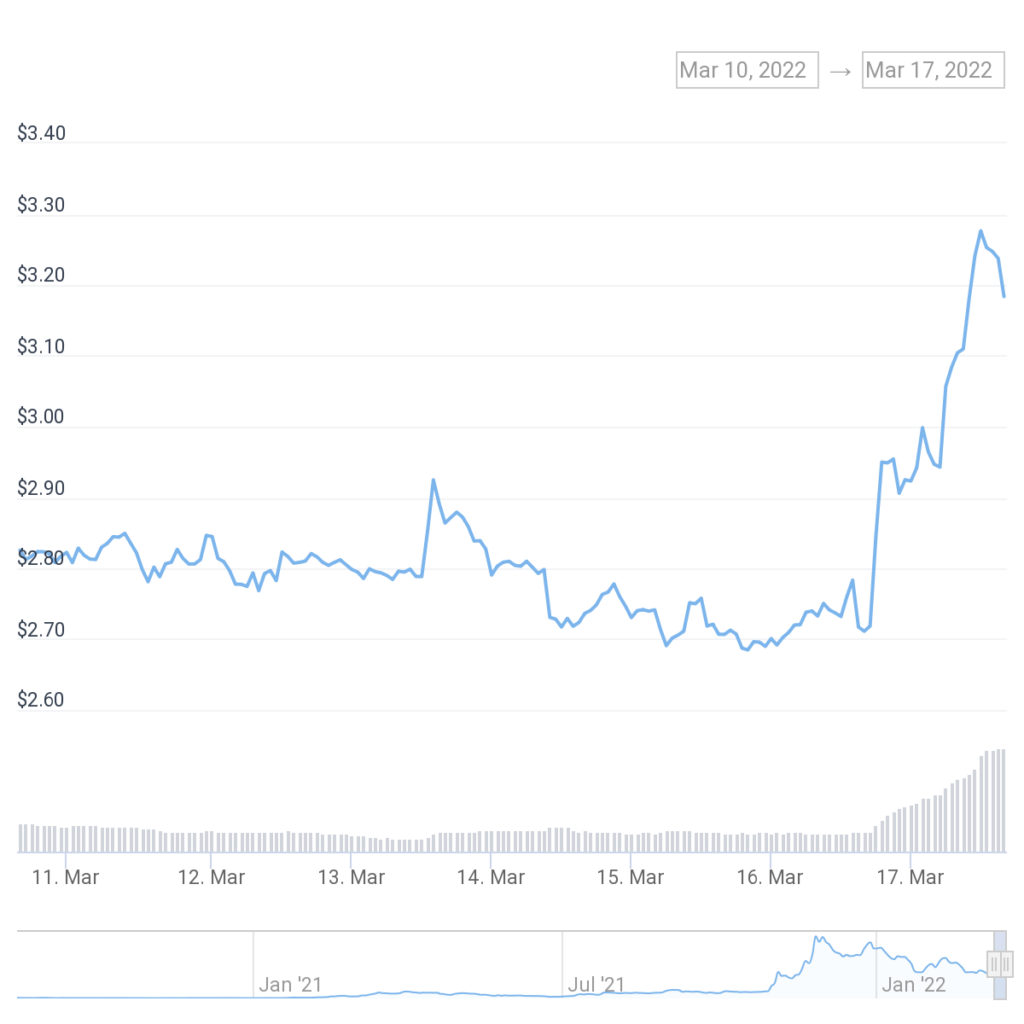

With the announcement of the HSBC partnership, and the launch of a new gaming level for owners of the Snoop Dogg NFT collection, the SAND token surged 17.5 per cent in 24 hours to a weekly high of US$3.28, according to data from CoinGecko.

Trading volume also spiked, the last week it averaged around the US$400-$300 million mark, as of Thursday, 17th March, trading volume had reached a peak of over US$1.46 billion.

Disclaimer: At the time of publication, the author of this article owned SAND and other cryptocurrencies.