“It is early, but not too early”: Wells Fargo analysts on Bitcoin investments

Analysts at the Wells Fargo Investment Institute have released a report detailing their take on investments in Bitcoin, saying it’s not “too late to invest”, but emphasised education.

The report details that Bitcoin has returned “some of the best performances over the past decade”, citing the price of Bitcoin compounding annually at a rate of 216 per cent since 2010. In comparison, the S&P 500 Index has compounded annually at 16 per cent over the same time period.

“We understand the “too late to invest” argument but do not subscribe to it. We believe that focusing too much on past performance, especially with cryptocurrencies, can be misleading to new investors,” the analysts said.

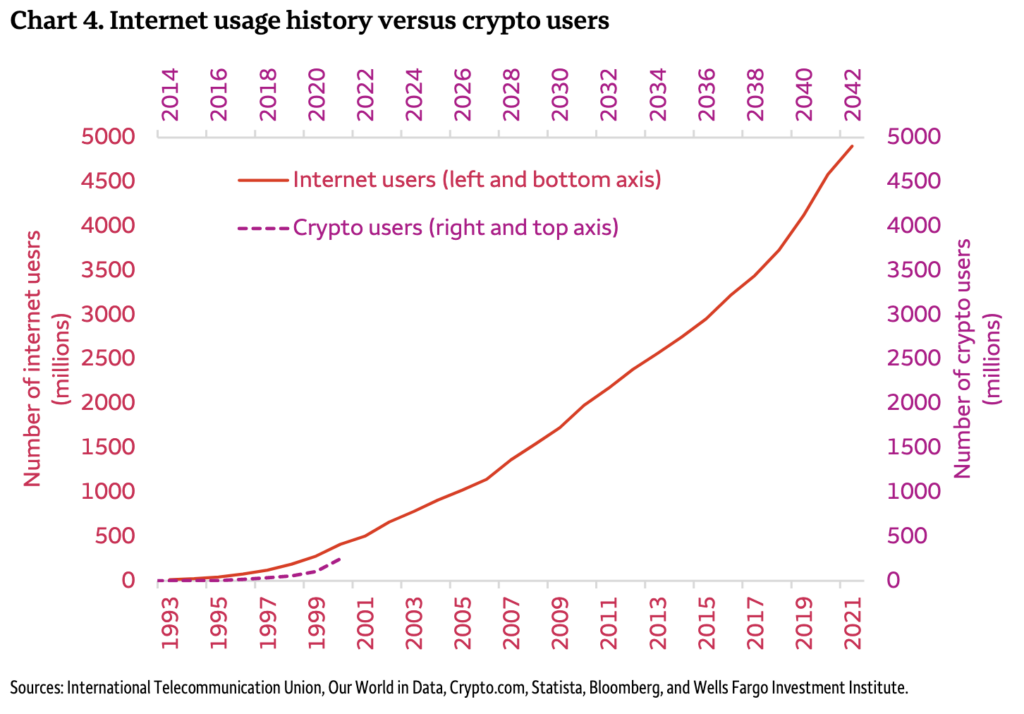

The analysts say they see cryptocurrencies in the “early, but not too early” investment stage. They also detail that cryptocurrency adoption has followed a similar pattern to internet adoption, stating that it often takes years before consumers widely adopt new and advanced technologies, and that cryptos seem to be near a point of large growth.

The analysts did emphasise education, patience, and care if investing in cryptocurrencies, saying that “most of the opportunity lies before us, not behind us”, presenting a graph showing that the market capitalisation of cryptocurrencies is less than that of Apple.

Related: The five questions to ask yourself before you buy crypto

Interestingly, the analysts recommended not to buy crypto directly from an exchange due to the complex technology and speculative nature of the investment.

The report also recommended not to buy U.S. mutual funds and ETF’s with exposure to cryptocurrencies as these are backed by futures, not the crypto assets themselves.

“For now, we suggest the consideration of only professionally managed private placements,” the analysts advised.

“We do not recommend any of the other current investment options, such as mutual funds, ETFs, grantor trusts, and individual cryptocurrency speculation. We are hopeful that greater regulatory clarity in 2022 brings higher-quality investment options.”