The path ahead for the Central Bank Digital Currency

In recent years, the implementation of a Central Bank Digital Currency (CBDC) has become a major point of discussion across both the public and private sphere.

China has already launched a trial CBDC, the digital yuan, and India will soon follow this year, with the Indian Prime Minister announcing plans for a digital rupee. Closer to home, the Reserve Bank of Australia (RBA) states it’s “actively researching CBDCs as a complement to existing forms of money.”

According to the international affairs think tank, the Atlantic Council, 87 countries are in the process of working on a CBDC, with nine nations having already launched a digital currency.

Understanding what a CBDC is and why they’re different from stablecoins will be an important subject to understand if and when the RBA rolls out an “eAUD”.

To find out more about this evolving space, CryptoVista spoke with Dr. Dimitrios Salampasis, Director, Master of Financial Technologies and Lecturer of FinTech Innovation and Entrepreneurship at the Swinburne Business School, Swinburne University of Technology in Melbourne.

We asked Dr. Salampasis to explain exactly what makes a Central Bank Digital Currency.

“A CBDC is central bank money in a digital form. It represents legal tender with the liability of the central bank,” he said.

“The supply and value of a CBDC is governed and determined by a country’s monetary policies, trade surpluses and of course the central bank.”

“A CBDC is not a cryptocurrency,” Dr. Salampasis clarifies, “its value is not fluctuating and is not equivalent to electronic cash.”

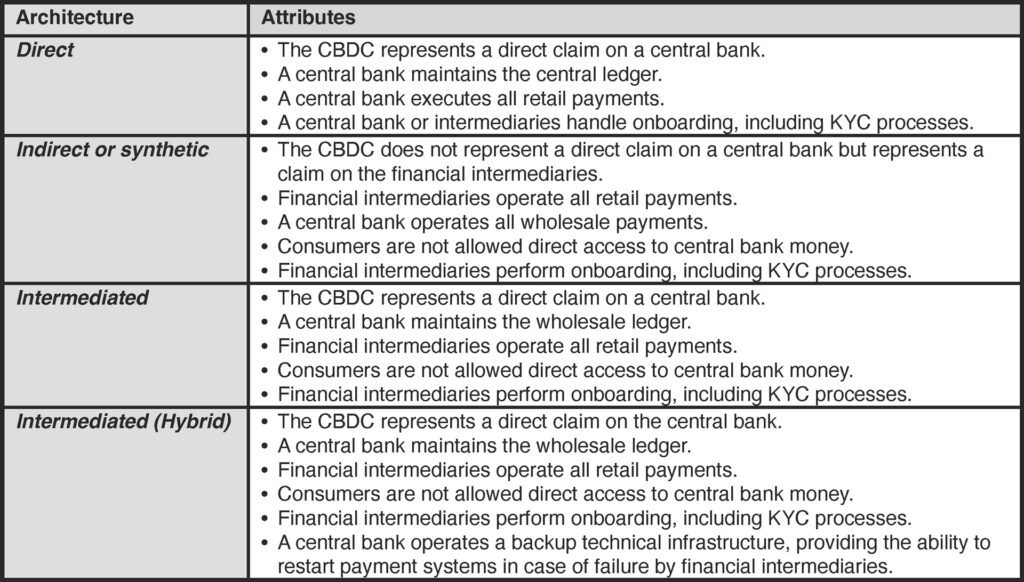

“Even though a CBDC is a based on a digital ledger, this is not necessarily blockchain or distributed ledger technology. Numerous central banks are exploring various architectural designs and technological infrastructures, but no real consensus has been reached.”

The similarities between stablecoins like Tether and a CBDC sometimes causes confusion to those accustomed to the crypto space. Dr. Salampasis went on to detail the differences between the two assets.

“The main difference between a stablecoin and a CBDC lies within the mode which the monetary system works,” he said.

“Stablecoins envision to minimise price volatility, this is why they are pegged mainly in a unit of account or a common store of value.

“A CBDC is completely regulated, monitored and governed by national monetary authorities,” he continued. “Moreover, stablecoins are meant to be decentralised, and often unregulated, while CBDCs are centralised, that means they would be controlled by permissioned governance arrangements.

“In most cases, stablecoins are unregulated, issued by private entities or organisations who control the supply, manage reserves, and are responsible for governing the overall arrangement with the ad hoc users.

“It can be argued that a CBDC could be considered a government-issued stablecoin, especially when we are referring to cross-border transactions and payments.”

Related: Indonesia’s Central Bank considers its own digital currency to ‘fight’ crypto

When discussing cryptocurrencies and how governments might react to policing existing decentralised digital assets if CBDCs are implemented, Dr. Salampasis said that regulations should complement the shifting economy.

“Cryptocurrencies are providing an alternative financial and money offering, leveraging decentralised architectural designs to create innovative but highly volatile products and services,” he said.

“What is really important moving forward is for all ecosystem stakeholders to adopt a coordinated approach and accept that the economy is shifting from dominance and monopolised custodianship to democratisation.

“The emergence of CBDCs and the creation of solid regulatory mechanisms are expected to bring clarity and will change the competitive dynamics, however the approach should be complementarity and co-existence.”

Discussion regarding what the most important aspect of a cryptocurrency is, often settles on the fact that cryptos are non-custodial, giving people complete control over how they store value.

With most CBDC’s in the early stages of research, or only being launched with initial pilots like the digital yuan in China, it’s unclear whether the central banks or the people will have custody of the asset.

“It is highly unlikely that we will ever go back into a pre-crypto era,” Dr. Salampasis said.

“Trust dynamics together with the culture and notion of money have changed completely, paving the way towards democratising access to unbundled financial services while rethinking the overall purpose of money, monetary systems, and global business.

“CBDCs are considered as the centralised and institutional response to cryptocurrencies and decentralised finance, endeavouring at the same time to ensure the relevance and dominance of fiat currencies, both in a retail, wholesale and global business setting.

“The rapid adoption of digital assets begins to question the vague role governments and central banks play as monopolised custodians of monetary and financial institutions. CBDCs can potentially lead to fundamental and deep structural changes in monetary policy with macroeconomic, monetary regulation, system-changing, and business competition implications yet to be understood.

“The objective of CBDCs should not be the direct clash and the catharsis of cryptoassets, rather than, co-existence and democratisation of the monetary system. CBDCs could transform international payments and potentially exacerbate currency substitution.”

Conversation around CBDCs is sometimes led by conspiratorial arguments, warning that a centralised government controlled blockchain will lead to complete control of individuals, with all transactions tied to a social credit system. We discussed this with Dr. Salampasis.

“A tipping point has been reached with crypto having numerous followers and believers around the world, creating a new model of decentralised capitalism,” he said. “Central banks could learn the lessons from history and provide digital versions of fiat currencies to effectively fulfil their public mandates.

“The digital evolution, effectiveness, and value proposition of CBDCs are grounded on the symbiotic cooperation between public and private stakeholders. Virtually no aspect of CBDCs is unchangeable.

“CBDCs can be perceived in a utopian way as a vehicle for accessibility, inclusion, and democratisation and a dystopian way as a vehicle for control, data exploitation, and money multiplication.

“Ultimately, it all comes down to the kind of economy architectural design and the kind of competitive dynamics Australia wishes to achieve. A constructive dialogue among all stakeholders is needed, from both a feasibility and desirability standpoint, in order to create this new type of money to benefit its stakeholders.”